audit vs tax big 4

The Big 4 is the name given to the four biggest accounting firms in the world PwC EY KPMG and DeloitteAll of them have grown to be multi-billion-dollar firms that employ. In this video I wont tell you If you are an introvert go into tax and if you are an extrovert go into auditBecause this is j.

Big 4 Consulting Firms Deloitte Ey Pwc Kpmg Mconsultingprep

Lets Talk Audit Vs.

. Hopefully I can help you unders. Statutory audit gives you a basic knowledge in almost everything. Im in corporate tax for a publicly-traded tech company but was previously in corporate tax for a large life insurer - pretty much every one of my colleagues Ive worked with.

Both tax and audit are within a big four. Ziphoblat 4 hr. Tax vs audit is a popular question from many big 4 candidates.

Which practice is better at the big 4. A Big 4 consultant may exit to MBB while a TAS may exit to BB IB. Public accounting audit and tax can both be lumped together with regard to hours because it really just depends on the office and the clients you get staffed on.

I recently got an offer to become a Tax Associate with the Big 4 working specifically on financial instruments. Big Four Accounting. Difficult question one only you can answer.

Both supply such services to. Tax is more specific to jurisdiction so you cant transfer across world. Hey folksIn this video I want to address a question I once had when deciding which career path to choose within the Big 4.

Which practice is better for you Audit or Tax. Today we will be covering the pros and cons of working in audit or tax accounting at the big 4 accounting fir. Alchemy-16 19 hr.

To me tax requires a lot. However at this time. 06192014 I wanted to gather opinions on the ideal industry path within Big Four CPA firms.

Are you interested in a career in accounting but dont know whether to choose Tax or Audit. Audit is lowest paying but is a solidstable path to a good career. If earning a larger salary is important to you.

Audit vs Tax Originally Posted. One caveat is that many firms will not hire undergrads directly into their TASFAS groups. Consulting is highest paying and probably most interesting depending on the specific type.

As a Tax Manager at one of the Big 4 Ive been happy with my dec. Depends entirely on your specialism. I really like audit but dont mind tax.

Tax has virtually no travel so youre less likely to be stuck late nights with your team spend unpaid time traveling or spend time overnight in a. Answer 1 of 3. When I started my career Id have chosen Big four.

I work in tax. Tax pays better but kind of pigeon. Audit is way better.

At A Big 4 What Generally Pays More And Has Better Fishbowl

A Cpa S Journey From External Audit To Internal Audit To Tax Gleim Exam Prep

Big Four Firms Test Audit Safeguards As Consultancy Booms

Ai In The Accounting Big Four Comparing Deloitte Pwc Kpmg And Ey Emerj Artificial Intelligence Research

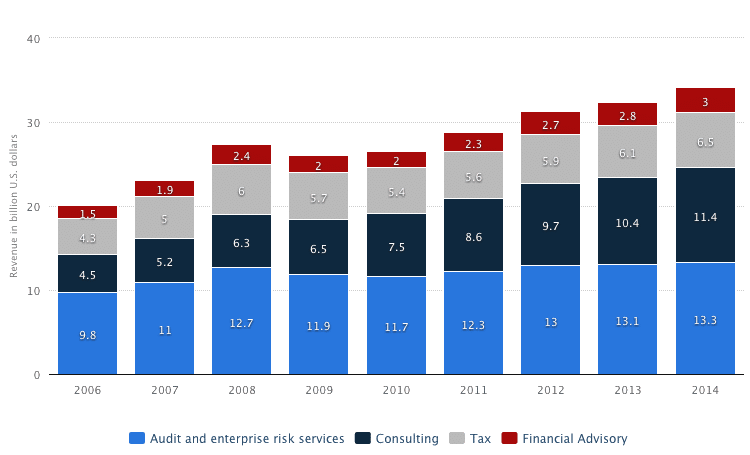

Which Big 4 Firm Makes More From Consulting Than Audit And Tax Combined Going Concern

Audit Or Tax Difference Between Audit And Tax Cpa Career Youtube

Tax Senior Accountant Job Description Velvet Jobs

The Big 4 Experience Pros Cons

Audit Associate Resume Samples Qwikresume

Who Makes Partner In Big 4 Audit Firms Evidence From Germany Sciencedirect

Uk Watchdog Urges Big 4 Accounting Firms To Challenge Clients As Audit Quality Slides

Audit Associate Resume Samples Velvet Jobs

Getting In The Big 4 As A Non Traditional Applicant

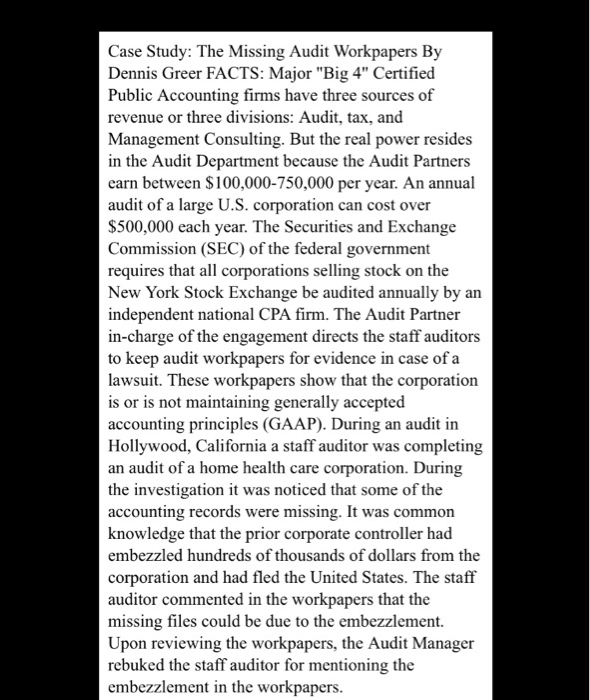

Case Study The Missing Audit Workpapers By Dennis Chegg Com

The Big 4 Accounting Firms Dominate The Audit And Tax Chegg Com

The Big 4 Accounting Firms The Complete Guide

Mconsultingprep 𝗛𝗢𝗪 𝗧𝗛𝗘 𝗕𝗜𝗚 𝗙𝗢𝗨𝗥 𝗙𝗜𝗥𝗠𝗦 𝗖𝗔𝗠𝗘 𝗔𝗕𝗢𝗨𝗧 The Big 4 Firms Deloitte Kpmg Pwc And Ey Are The Four Largest Professional Service Networks In The World Offering Services

Tax Haven Networks And The Role Of The Big 4 Accountancy Firms Sciencedirect